how to short a stock td

Short stock trades occur because sellers believe a stocks price is headed downward. How to short a stock First youll need a margin account.

/Fidelityvs.TDAmeritrade-5c61be4546e0fb00017dd69a.png)

Fidelity Investments Vs Td Ameritrade

Heres how you can set up a short on the Tesla stock.

. Shorting stock involves selling batches of stock to make a profit then buying it back cheaply when the price goes down. If there are shares available to short your order will be filled. Shorting a stock is as simple as buying and selling any other publicly traded stock on TD Ameritrades website.

Enable margin trading in your account Make sure you have at least 2000 in your account this is the minimum allowed to help cover losses Wait approximately 3 business days for your margin trading account to be active Enter an order in this case Tesla and indicate that youre short selling. Assume the trader entered a market short-sell order for 100 shares when the stock is trading at 50. A Buy-In can happen without prior notice to you.

You have to specify that youre planning to short this particular stock. How to Sell Short. Seeking the Upside of Downside Markets.

It works the same as it would on any other platform. Open a TD Ameritrade Account. Enter Your Order to Sell Short Once youve enabled your account for margin you can enter an order to short sell a stock.

Identify the stock that you want to sell short Create a tastyworks margin account or log in Decide how you want to short the stock Open your short position Monitor and close your open short position 1. After you short the stocks your brokerage may require you to close the position at any. So what does short selling mean.

How to buy a put option. Enter a regular sell order to initiate the short position and your broker will locate the. This creates a pop-up order ticket which can be integrated into the platform by editing it.

When TD Direct Investing is recalled on the equity they borrowed to protect your position. Especially from the perspective of a fundamental investor who spends a lot of time researching individual companies the ability to short a stock can lead to. Stock prices can be volatile and you cannot always repurchase shares at a lower price whenever you want.

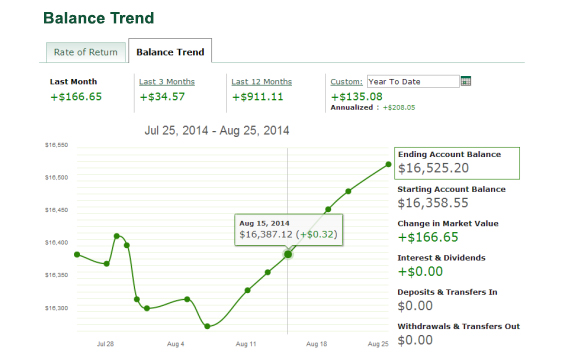

Trade Ideas Scanners Best Scan. As the price of the shorted stock moves Etrade will reveal this as possibly an unrealized gain or loss inside your account by marking your trousers to market. When filling in this order the trader has the option to set the market price at which to enter a short-sell position.

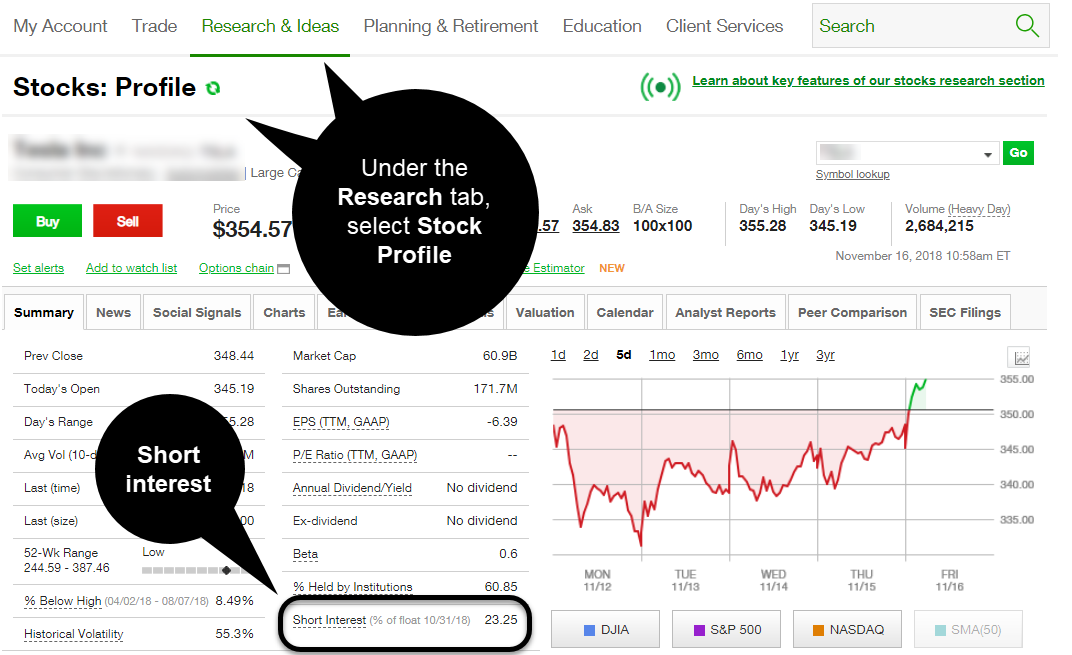

Placing a short sell on TD Ameritrade is similar to how you would place a standard long trade except you will select Sell short for the action. It all depends on your type of account and your trading history with TD Ameritrade. How to short stock w Td Ameritrade 3 minFacebook.

Find a stock that you think is overvalued. When it comes to shorting stocks there are a few different ways you can do it. Buy a put option on that stock.

Margin trading privileges subject to TD Ameritrade review and approval. During our testing we found the simplest method to establish a short position was to right-click on a chart and select sell from the drop-down menu. Borrowing shares from the brokerage is effectively a margin loan and youll pay interest on the outstanding debt.

To capitalize on this expectation the trader would enter a short-sell order in their brokerage account. Wait for the stock price to go down and then sell the option back. The process for obtaining.

In the below example you can see that we are looking to sell short 100 shares of AAPL with a limit price of 15340 per share. Understand How Shorting Works Understanding how shorting works is key for your desired outcome. How to short stock w Td Ameritrade 3 minFacebook.

If the price of that stock drops to 80 you can buy it back at that price return the stock to your brokerage company and keep the 20 difference as profit. When TD Direct Investing is unable to borrow shares to protect the position. Like many retail investment platforms TD Ameritrade has allowed investors to trade stocks on margin and to take short positions in stocks.

TD Ameritrade Short Selling Stocks. Buy-In of the Short Position You can be forced to buy the shares you are short a Buy-In on two occasions. Once on the Accounts Details page select the TD Direct Investing CAD or USD Margin Short account you want to trade in and follow the steps.

Pin By Dropz On Money Tips Money Tips Short Stock Positivity

Best Investing Resources To Use Investing Investing Strategy Income Investing

Td Ameritrade Short Selling Stocks How To Sell Short Fees 2022

The Short And Long Of It Your Top Questions On Short Ticker Tape

Stock Market Quick Start Guide Stock Market Stock Market For Beginners Stock Market Basics

Learn How To Place Trades And Check Orders On Tdameri Ticker Tape

What Is Uvxy Proshares Ultra Vix Short Term Futures Etf Https Investormint Com Investing What Is Uvxy Investing Stockmarket Etf E Trade Investing Trading

Short Selling Stocks Td Direct Investing

Short Selling Stocks Td Direct Investing

Most Popular January Stocks Value Investing Investing Finance

Short Selling Stocks Td Direct Investing

Learn How To Place Trades And Check Orders On Tdameri Ticker Tape

How To Swing Trade Penny Stocks Penny Stocks Swing Trading Stock Chart Patterns

Td Ameritrade Short Selling Stocks How To Sell Short Fees 2022